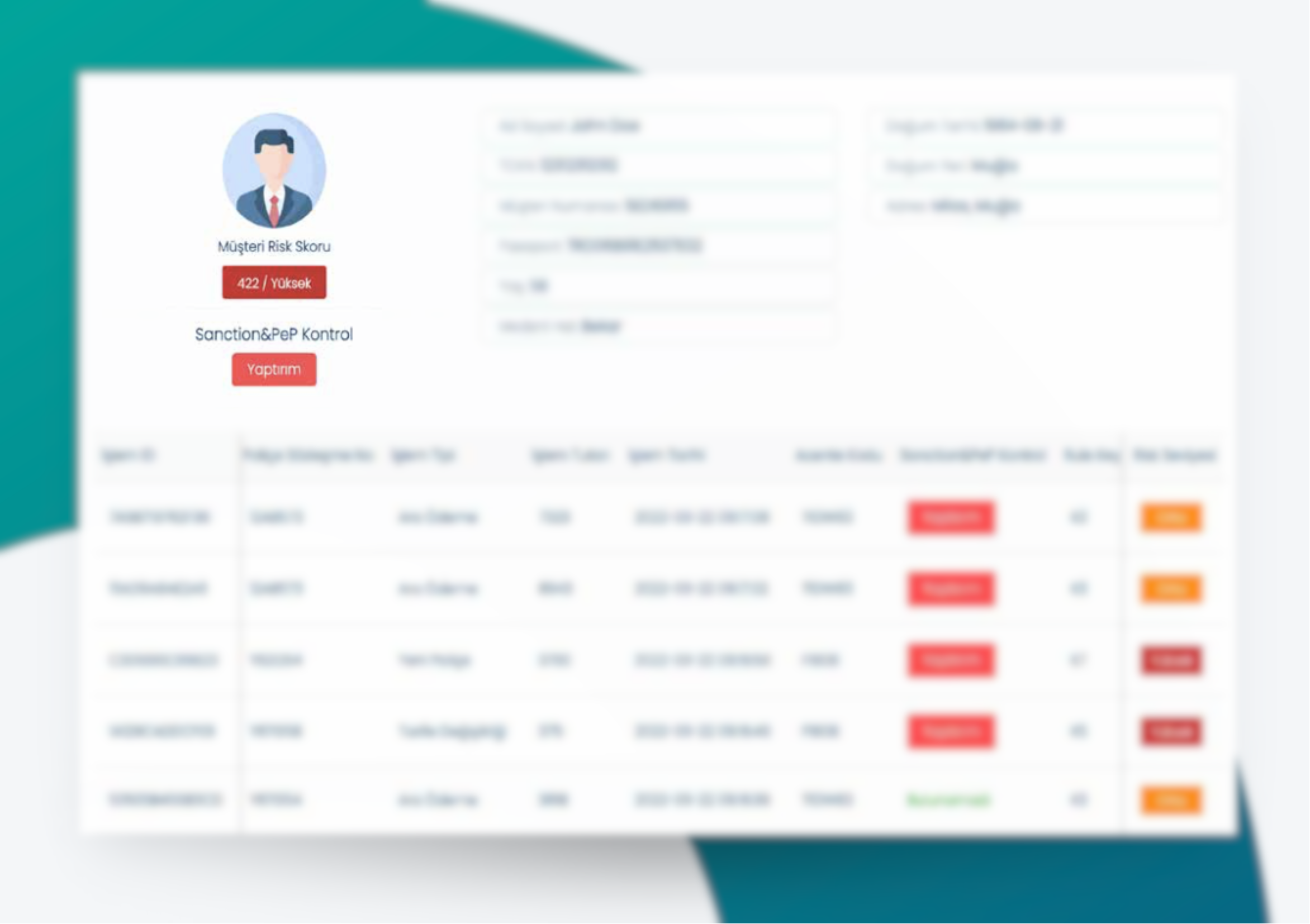

Transactions - Customer Profiling

Identifying Customer Risk with AML Customer Profiling

Customer risk is a major concern for financial institutions and forms a fundamental part of the anti-money laundering (AML) process. This solution assists financial institutions in objectively assessing the risk of each customer. The ability to determine customer risk with AML Customer Profiling enables financial institutions to closely monitor high-risk customers and detect potential financial crimes.

Risk-Based Approach with AML Customer Profiling

The risk-based approach allows financial institutions to better understand customer risk. This solution categorizes customers into low, medium, and high-risk categories, helping them allocate resources most effectively. Low-risk customers require fewer resources, while high-risk customers receive greater attention and monitoring.

Risk-Based Identity Verification with AML Customer Profiling

Identity verification is of critical importance to financial institutions and is essential for compliance with legal regulations. AML Customer Profiling strengthens identity verification processes and provides risk-based identity verification. This helps financial institutions more securely verify the identities of their customers and pay closer attention to high-risk customers.

Automated Detection of Suspicious Indicators with AML Customer Profiling

Early detection of suspicious indicators is critical for preventing financial crimes. AML Customer Profiling solutions automatically detect suspicious indicators such as large cash transactions, unusual transaction patterns, and insufficient transaction descriptions. This enables financial institutions to quickly identify and report suspicious transactions.

Transaction Monitoring and Analysis with AML Customer Profiling

AML Customer Profiling helps financial institutions continuously monitor and analyze customer transactions. This solution analyzes data such as transaction amounts, transaction dates, transaction types, and customer information. These analyses aid in identifying suspicious indicators.

Automatic Alerts and Reports with AML Customer Profiling

When suspicious indicators are detected, AML Customer Profiling automatically generates alerts and reports. These alerts promptly notify financial institution employees and authorities about suspicious transactions. Additionally, the reports assist financial institutions in complying with legal regulations.

Customer Information Updates with AML Customer Profiling

Maintaining up-to-date and accurate customer information is crucial for financial institutions. Our AML Customer Profiling service ensures regular updates of customer information. This guarantees that customer identity verification is consistently performed and kept current.

Legal Compliance with Customer Information Updates

Compliance with legal regulations is a critical requirement for financial institutions. Customer information updates help financial institutions maintain compliance with legal regulations. This assists financial institutions in avoiding legal risks and fulfilling requirements imposed by regulators.

Enhancing Customer Awareness with AML Customer Profiling

Our AML Customer Profiling service helps financial institutions build greater awareness about their customers. It raises awareness among customers about the seriousness of financial crimes and encourages cooperation with financial institutions.

AML Customer Profile solutions are a strong partner for financial institutions in detecting and preventing financial crimes. These solutions help financial institutions reduce customer risk, detect suspicious signs, and update customer information.

Request Demo

You can contact us as to our services, integration processes, request demo or customized solutions.